Ramping Up

Overdraft: the first trustless layer between banking and blockchains. DeFi’s new frontier.

The current consensus is that integration of fiat and crypto is the exclusive domain of centralised exchanges/providers. Mainstream integrations are clunky, costly, and inherently custodial. Users who need to swap between on-chain money and fiat bank money are penalised worldwide. Its inefficiency would seem strange, were we not so used to high fees, unjust debanking, and excessive waiting times. In March 2024 alone, more than $40bn USD was traded from fiat into stablecoin pairs, but liquidity is fragmented across the top ten providers (Coinbase, Kraken, Binance etc), almost all of whom have perverse incentives: the casino doesn’t want you to leave. There’s an increasing risk of funds being arbitrarily frozen by exchanges, or of being flagged as suspicious by the receiving/sending bank.

Novel MPC research applied to Ethereum’s trustless escrow drastically alters this: we can now credibly prove to a third party that Alice sent $100 to Bob, and that Bob’s escrowed USDC should be sent to Alice’s Base wallet. Bob does not need to trust Alice. Alice does not need to trust Bob. Using the Overdraft Protocol, they can swap between fiat and crypto without needing to trust a centralised intermediary to custody their coins, or to ever go via a CEX.

The Overdraft Protocol is a composable layer for fiat and crypto interactions which glues together disparate banking and blockchain systems. Its foundational use case is to enable trust-minimised swaps. Currently, different ecosystems (e.g. Ethereum, EU banking systems) are essentially monolithic and paths between them extract rents, as ‘trolls under the bridge’ that stifle innovation. Overdraft solves this.

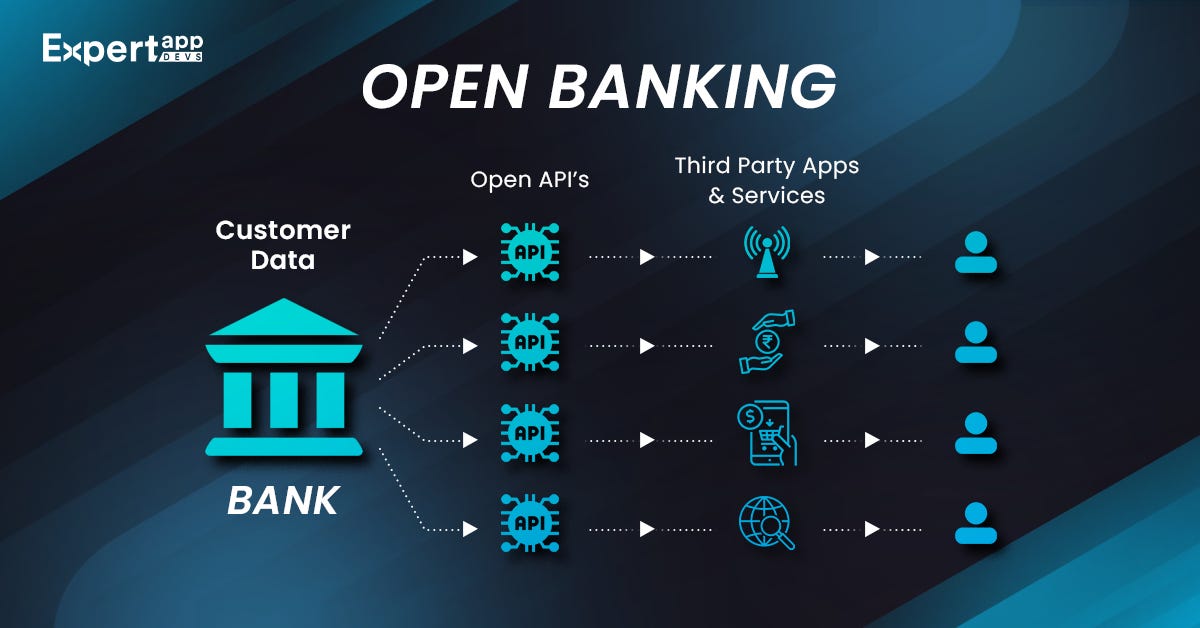

How does Overdraft work? How can we prove on-chain that a private bank transaction took place? The answer lies in Open Banking, an area of fintech that is surprisingly obscure to many people in DeFi, despite bearing strong resemblance to crypto (albeit in a permissioned way). It’s defined by Patrick Collison of Stripe as:

‘a financial services model that allows third-party developers to access financial data in traditional banking systems through APIs. This model completely changes the way financial data is shared and accessed’.

One way of thinking about it is a ‘block explorer for private banking data’, or a permissioned Etherscan. It’s mandated in the EU and Great Britain, and to a similar standard (although for commercial, rather than legal, reasons) in the US, India, Canada, Singapore, and Australia, to name a few. We can query Open Banking APIs and create proofs of the results using MPC techniques pioneered by TLS Notary, which can then be submitted on-chain. This gives all crypto<>fiat interactions the privacy, speed and certainty of domestic payment rails, without having to align the whole of the world to a single standard. We call it programmable fiat.

This makes a much more efficient (and robust!) portal between the two monetary systems and should lead to minimal friction and cost for all users. In this paradigm, the word ‘ramp’ becomes outdated: a ramp is useful for perhaps a skateboard, or a disabled person. It’s often makeshift, hastily implemented, and favours a single direction. Overdraft resembles a viaduct: strong foundations, reliable, and capable of immense bidirectional flow to supply an entire economy. So we’re even more excited about the design space of what can come after the relatively elementary swapping of currencies, such as the blending of on- and off-chain credit, or products for global money movement that bypass SWIFT.

What needs to be solved to build the viaduct? The main issues we have identified so far:

KYC/AML

Patrick Collison says that we might ‘in some blurry sense, look at crypto as the part of financial services that is de facto exempt from AML by design’. This makes integrations high risk. Centralised exchanges have grappled with KYC for over a decade (and are often very successful companies), and the likes of Chainalysis, Elliptic, and Onfido are all working on this problem. As long as KYC does not create too much friction (especially around legitimate privacy concerns), then it’s not insurmountable - we can remove toxic flow without negatively affecting the UX of law-abiding individuals. Momentum in KYC solutions, combined with parallel developments in on-chain identity (e.g., WorldCoin / the World Network) give reason for optimism.

Proof Generation

We can decentralise attestations to proof generation using our novel MPC protocol, Locksmith (in development). It’s inspired by TLS Notary and is a significant innovation in the field of web proofs, aka ‘zkTLS’. It allows us to achieve extremely high security (for privacy and collusion-resistance) on data that is submitted to the proof, giving very high confidence in the proof’s veracity.

Liquidity

The cold start problem: it’s obvious why the one-millionth customer would use this, but the first person needs at least one counterparty. To solve this, we can bootstrap initial liquidity in major pairs from our balance sheet, making Overdraft useful from Day Zero.

Peace of Mind

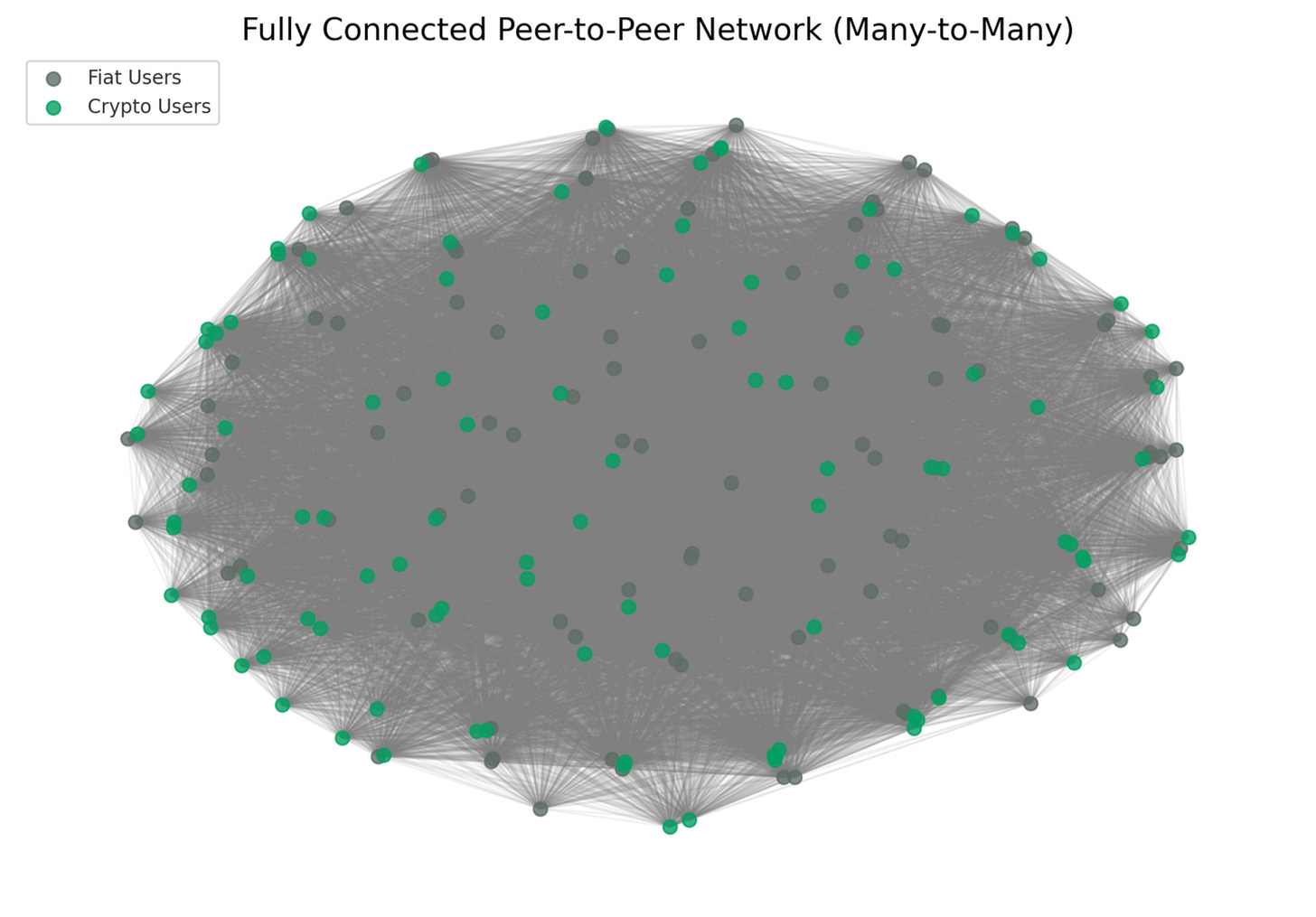

Some people will feel uneasy sending money to counterparties they don’t know, similar to ideas like online dating, videogame friends, or even e-commerce, which seemed destined to remain niche. There may be uncertainty even for approved, KYCd individuals. There are valid (psycho)logical reasons for this, but the worry is somewhat misplaced, since centralised exchanges are known to be associated with crypto, whereas KYCd individuals are far less salient from a compliance perspective. This is due to the intended many-to-many structure of the network, which is completely different to the current structure of fiat<>crypto flows, shown below:

With so few threads, cutting access to fiat<>crypto is not difficult for the Fates, as we saw during Operation Choke Point (see Nic Carter). Our intended network structure is far more robust, with thousands of potential threads (not accounting for possible Pareto distributions):

In this model, the exchanges/gateways may still exist, but their fiat<>crypto role is redundant, since there are many alternative routes. From an individual compliance perspective, banks usually know when you are interacting with one of ten centralised exchanges, which immediately flags as a risk. However, a bank transfer to John Appleseed who has no clear affiliation to crypto, which could be one of 1,000² possible interactions, is (ceteris paribus) hard to establish as suspicious. Also, some exchanges are not always incentivised to properly KYC their users, either because of trading fees, or the need for liquidity (or worse), evidenced by Binance’s flagrant AML breaches. A P2P network’s value, on the other hand, is hugely damaged by toxic flow, and therefore is hugely incentivised to minimise all risks to end users and ensure that counterparties are clean.

Regardless, adoption won’t be instant:

Contactless payments are also a good analogue:

Emergent phenomena from this will be interesting, as will the more concrete implications for stablecoins. We imagine this will significantly increase their liquidity and robustness, and serve as essential ‘grease’ between stables and bank-custodied fiat.

We’re excited to be building the plumbing for global money. It’s hard to imagine a successful civilisation without trust and sound money, and we believe that the economic development catalysed by blockchains and internet money will be of immense value to the citizens of earth today and of the multi-planetary humanity of tomorrow. If you’re interested in helping to architect and implement these systems, reach out to us on Twitter (DMs open) or join our Telegram Community here.